Last week, California Governor Jerry Brown signed a new law that amounts to a big victory for startups and their investors. Assembly Bill No. 1412 reverses a 2012 administrative adjustment that would have resulted in massive retroactive taxes on investors and small business owners. Perhaps more importantly, it would also have meant higher taxes on new early-stage investments going forward.

In response, Engine conducted an analysis conservatively estimating that the effective tax increase would result in a two percent decline in early-stage investments in startups each year in California, translating to a drop of $85 to $127 million in capital for young businesses with the highest growth potential. By showing lawmakers the potential cost of the new tax, Engine’s analysis directly helped to frame the debate.

Let’s recap quickly: In December 2012, the California Franchise Tax Board announced changes to capital gains tax exclusions on Qualified Small Business stock holdings. This stemmed from an appellate court ruling that found minimum in-state asset and employment requirements during the holding period of the QSB stock unlawful under the U.S. Commerce Clause. But rather than removing the in-state requirements, the tax board eliminated the capital gains tax exclusions altogether -- throwing the baby out with the bathwater.

Entrepreneur Brian Overstreet brought attention to the issue when he pointed out that the FTB decided to make the tax retroactive, adding penalties and interest! Understandably, investors were furious about the retroactive nature of the tax increase and being penalized for following then-current law. While that’s a fair complaint, we were most concerned with the impact this would have on startups moving forward. Engine’s estimate on the new rule's impact on startups empowered advocates with a data-rich perspective on future investment, business, and employment growth.

“Many people played pivotal roles in this process, including Senator Ted Lieu (D-Torrance) and Jeff Gorrell (R-Ventura), and other legislators and business groups,” said Brian Overstreet. “Beyond the basic rule of law and the issues of fairness that this issue posed, the debate ultimately came down to the economic impact of FTB’s action,” Mr. Overstreet continued. “In that regard, the work that Engine did to quantify the decline in investments in California’s start-ups that would result from the retroactive tax proved pivotal. That report was shared among legislators and members of the media to great effect.”

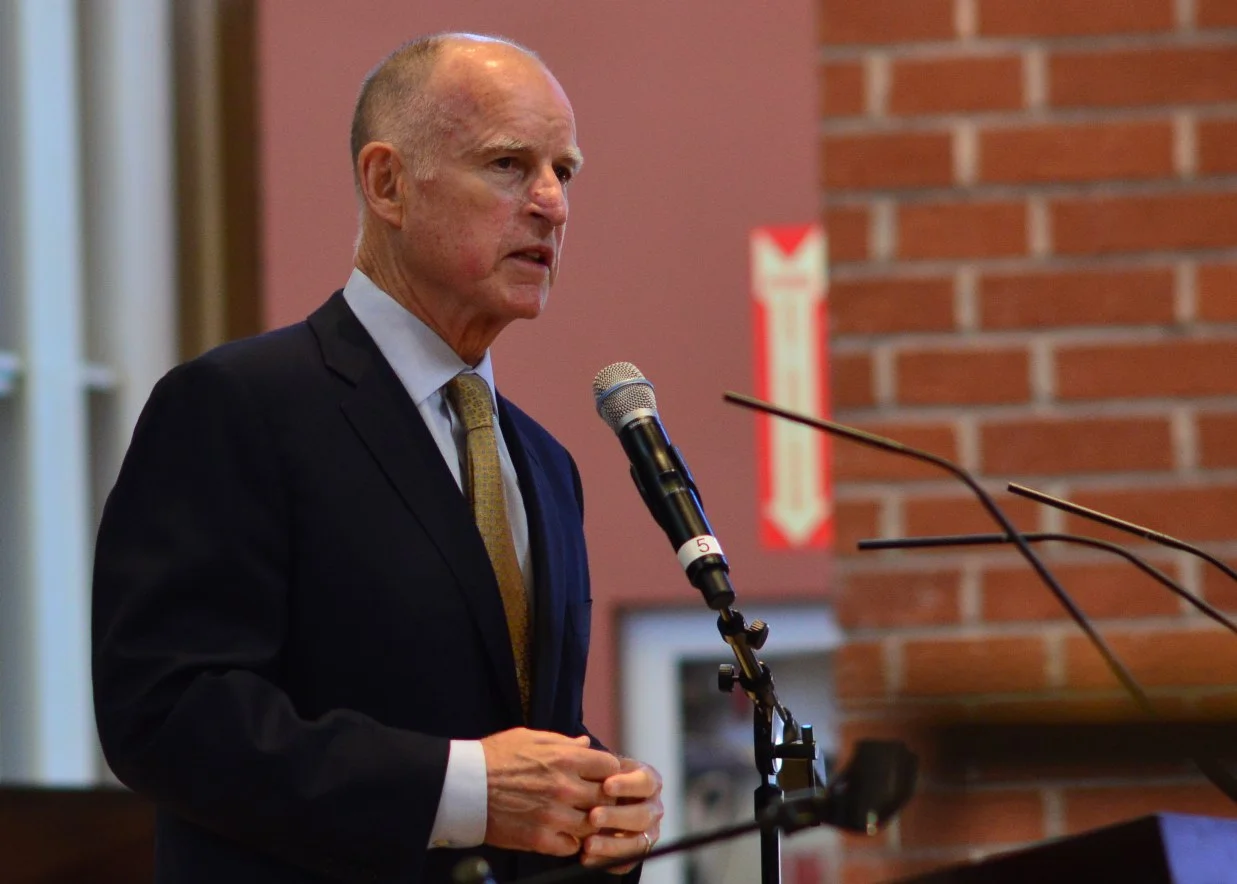

We applaud Governor Brown, Senators Lieu and Gorrell, Mr. Overstreet, and countless others who were involved with the passage of Assembly Bill No. 1412, and congratulate the California startup community on this critical development.

Image courtesy of Neon Tommy