Competition issues are in the spotlight in D.C. and state capitals across the country. At Engine, we’re encouraged when lawmakers think about ways to boost competition and innovation, as startups stand to benefit if sound policy makes it easier for small and new companies to launch and grow. But much of the current policy conversation is centered around a few companies and fails to consider the impacts policy decisions will have on the rest of the technology ecosystem, which is inherently interconnected.

That interconnectedness is on full display, for example, when considering how startups routinely rely on low-cost services provided by other (often bigger, more established) companies. These tools and resources make it easier—and in some cases make it possible—to start and scale a nascent tech business. Startups are also often creating follow-on goods and services made possible by markets and tools built by other companies. And acquisitions by larger companies are a crucial off-ramp for startup founders and investors looking to recoup —and often then reinvest within their communities—their funds.

Currently, lawmakers in Congress are considering several competition proposals, including five that are headed for a vote in a House Judiciary committee next week. The five bills tackle a number of issues (touching on everything from data portability, to filing fees, to whether a company can offer some of the features and tools consumers use often). But one, the Platform Competition and Opportunity Act from Rep. Hakeem Jeffries (D-NY), effectively prohibits companies of a certain size from acquiring smaller companies. For an acquirer to get around that prohibition, it must meet the high bar of proving with clear and convincing evidence that the company being acquired doesn’t currently compete or couldn’t potentially compete with the acquirer and that the acquisition doesn’t help the acquirer maintain or increase its market position.

Overall, acquisitions are a critical part of the startup ecosystem. Admittedly, there are some acquisitions that can harm competition and innovation, for example by eliminating would-be challengers or allowing one company to stifle innovative new tech by acquiring it just to deliberately shelve it. But every startup has limited exit options—with a majority hoping to be acquired.

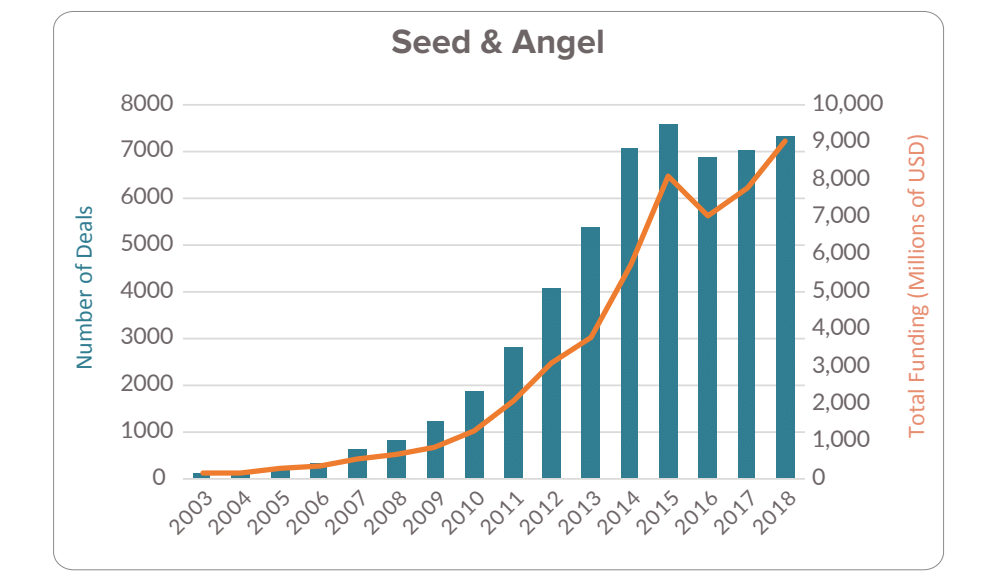

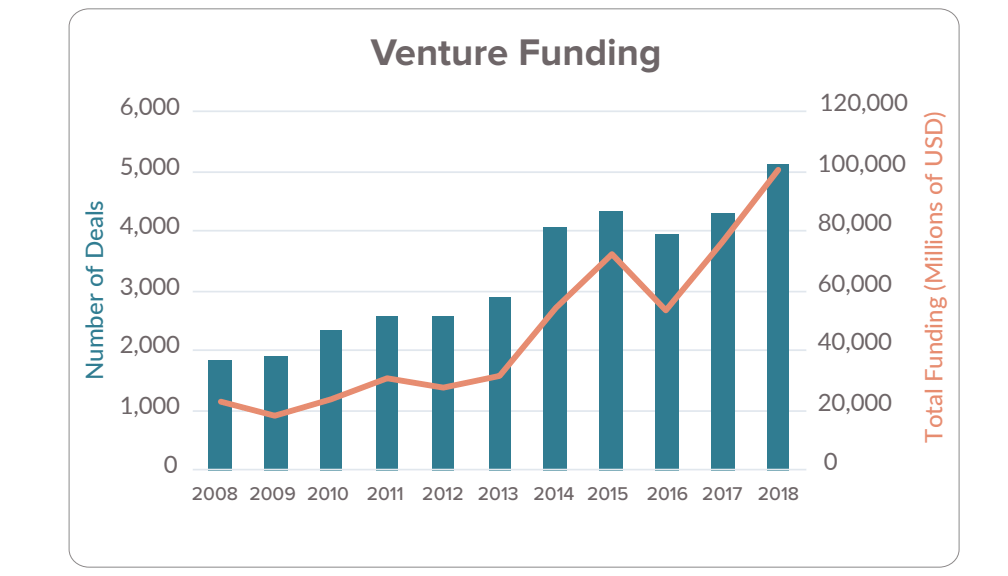

We explored this point in our State of the Startup Ecosystem report earlier this year. First, the report showed that both the amount of money invested in and the number of VC, angel, and seed-stage startups have grown over the last 15 years.

Startup exits have increased in number and value—by 383 percent and 1847 percent respectively from 2003 to 2018. Most relevant to the ongoing policy conversation, the report also reveals how the relationship between acquisitions and investments are strongly and positively correlated over the same period.

That strong, positive relationship does not exist between investment and IPOs, the other oft-cited exit opportunity for startups. For a variety of reasons—including regulatory and logistical obstacles that make an IPO more time- and cost-intensive—in addition to personal preference, the vast majority of startups look for other exit opportunities, namely acquisitions. And while acquisitions remain the most common and steady portion of the growth in exits, as the venture capital community has pointed out, acquisitions have been “commonplace in the U.S. since before the dawn of the modern venture capital industry.”

According to our report, the value of acquisitions rings especially true for the many startups that are outside of the top startup hubs (i.e, outside of places like Silicon Valley, Los Angeles, Boston, and New York). From 2010 to 2018, for example, the average value of an acquisition was greater for companies outside the top nine hubs, compared to acquisition value nationwide. The opposite is true for IPOs. While the number and value of startup IPOs has also grown over the past decade, and those numbers fluctuate, the average IPO value has consistently been lower for companies outside of the top nine hubs compared with the rest of the country every year since 2010. “Tech” may be synonymous with “Silicon Valley” for many, but startups are launching, growing, and being acquired all across the country.

The U.S. startup ecosystem is healthy and growing, and we hope lawmakers will be careful not to enact policies in the name of reining in “Big Tech” that have harmful downstream effects on startups. Instead, we encourage lawmakers to focus on creating regulatory and legal environments that enable even the smallest companies to start up and attract investment, especially as policymakers think about broader economic recovery and U.S. global competitiveness.